Paying for a graduate degree might be difficult because an MBA can cost well into six figures. To finance at least some of the costs, you might need to take out a student loan. Graduate school loans can have high-interest rates, making debt a significant burden. But, more importantly, are MBA student debts worthwhile?

Thousands of graduate programs at colleges across the country leave students with mountains of debt and subpar wages. Many master's students have accumulated debt that their earnings will not be able to pay once they graduate.

Federal data reveals a wide range of outcomes for examining wages and loan repayments two years after graduation. Stanford Graduate School of Business, Dartmouth College's Tuck School of Business, and the University of Pennsylvania's Wharton School are three of the finest MBA experiences based on debt and earnings.

Debt-To-Income. Tuck, Stanford, and Wharton MBAs Have the Lowest Ratios

MBA graduates at Tuck borrowed an average of $41,000 and earned an annual median income of $167,295 two years after graduation. These figures result in a debt-to-income ratio of 0.25, comparable to Stanford's MBA program and among the best in the country. The median debt among MBA graduates at Stanford was $41,000, with a two-year income of $163,337. The debt-to-income ratio at Harvard Business School was the lowest of any MBA program: 0.24.

A debt-to-income ratio greater than one suggests that two years after graduation, a typical student will have more debt than income. A ratio of less than one indicates that the average graduate's income exceeds their debt. Debt counsellors usually advise students not to get into debt.

According to the research, graduate students were expected to borrow the same amount as undergraduates last year.

You'll discover some strange outcomes in some of the numbers, as with all data sets. According to federal data, Kellogg School of Management MBAs at Northwestern University earn more than any other MBA grads two years after graduation: $189,565.

Furthermore, the debt and income estimate frequently have no resemblance to MBA debt levels at graduation. That's because those debt levels only apply to students who borrow money, not to pupils who don't. It's also because many grads may be able to pay off a significant portion of their debt with their sign-on bonuses, which in consulting can be as high as $35,000.

Tips on Getting an MBA Loan

When looking for an MBA education loan, you'll have several options and bank return policies from which to choose. As a result, making the right decision becomes even more critical. The following advice will come in handy as you make your decision.

Examine all your options: Do thorough research on all the loan possibilities available from various banks. Choose what best suits your needs.

Keep an eye out for hidden fees: Some banks have hidden fees when applying for an education loan. Late fees, prepayment costs, and so on are only a few examples. Make sure you don't fall prey to it.

Only borrow what you need: Don't overextend yourself when considering an education loan. Make an approximate estimate of all your expenses, keep it to a bare minimum, and borrow the smallest amount possible.

Negotiate with the Bank: Try to get the processing charge on your education loan reduced or waived by negotiating with the bank. This charge is a percentage of the education loan amount that you have borrowed that banks levy.

While the reputation of the B-school and its placement records are very subjective, the financial security that allows the person to choose whether or not to take out an education loan is essential.

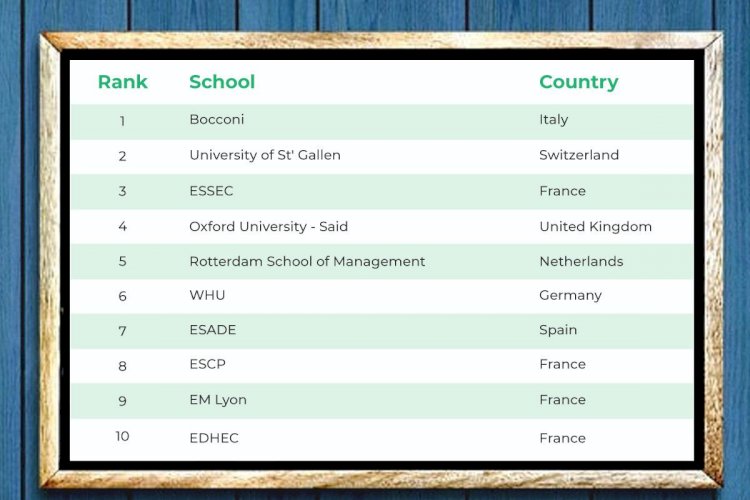

Also read: What are the world's most prestigious MBA programs?

MBA Center Global

MBA Center Global